The Budget 2014 brought in a major amendment which has impacted the whole online industry and especially the content industry wherein most of the Indian bloggers earn money through Ad Sales. Arun Jaitley while presenting the Budget 2014 announced that now Service Tax @ 12.36% would also be levied on Ad Sales on Digital Media i.e. Websites & Mobiles.

The date from which the Service Tax on Online Ad Sales would be applicable was not announced. However, last week on 25th August – the Ministry of Finance released Notification No. 18-2014 stating that Service Tax on Ad Sales on Websites and Mobiles would be applicable from 1st Oct 2014. The same has been reaffirmed by Pt 1.3 of this letter dated 25th Aug.

Service Tax On Website And Mobile Ads

What Is Service Tax? When any good is manufactured in a factory – Excise Duty is levied. When any good is sold in retail – VAT is levied. Similarly, when any service is provided – Service Tax is levied. These 3 are the most common types of Indirect Taxes which are levied on a business.

Service Tax is levied on all types of services in India except a few specified services. Earlier, Ad Sales on Websites and Mobiles was also included in these specified services (also known as Negative List of Services) but from 1st Oct 2014, Digital Ad Sales won’t form a part of the Negative List and therefore Service Tax would be levied.

From 1st July 2012 till 30th Sept 2014, Digital Ad Sales were specifically exempted from the levy of Service Tax. However, from 1st Oct 2014 Service Tax @ 12.36% would be applicable on all digital ad sales. It is pertinent to note here that other services provided by Website owners like Affiliate Sales, SEO Consultancy, Commission Income etc were earlier as well chargeable to service tax and would now also be chargeable to Service Tax.

Computation of Service Tax

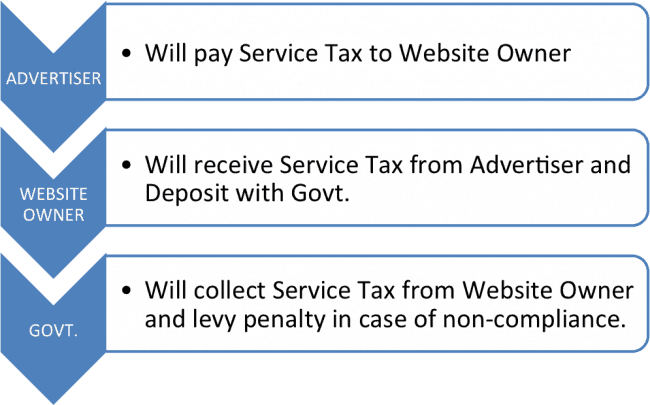

This Service Tax is not to be paid by the Businessman from his own pocket but is required to be collected from the person to whom the sale has been made. Let me explain this with the help of an example.

The best example which I can think of and which most of you would be able to correlate with is the Internet Bill or the Telephone Bill. Over and above your usage charges, these service providers levy Service Tax @ 12.36%. The Service Tax collected from you by the Service Provider is deposited with the Govt. Therefore, the component of Service Tax collected from you does not go into the pockets of the Service Provider as it is deposited with the Govt.

Just like these Telecom Service providers charge Service Tax from you and deposit the same with the Govt, the website owner on whose website the ad has been displayed would be required to collect the same from the company whose product is being advertised.

The manner of levy of Service Tax would be as follows:-

- Ad Sales Rs.20,00,000

- Service Tax @ 12.36% Rs.2,47,200

- Total amount payable (incl. of Service Tax) Rs. 22,47,200

This Rs. 2,47,200 collected as Service Tax would then be required to be deposited with the Govt. In case you don’t collect this amount and only charge Rs. 20,00,000 it would be deemed that Rs. 20,00,000 charged is inclusive of Service Tax and in that case – the Website owners would be required to pay Service Tax from their own pocket.

Exemption from Service Tax

Certain exemptions are available from levy of Service Tax which are as follows:-

1. Export of Service: If any Service is exported out of India, Service Tax would not be levied on such export of service.

2. Small Scale Exemption: Small scale service provider i.e. whose aggregate total value of all services provided during the year to all service recipients from all services does not exceed Rs. 10 Lakh can claim Small Scale Exemption. The Rs. 10 Lakh turnover would be computed after excluding the export Sales.

Additional Compliance Burden for Website Owners

The levy of Service Tax will lead to additional compliance burden for Website owners as the following additional things would now be required to be done:-

1. Apply for Service Tax Registration

2. Collect the Service Tax from the Company who product is being advertised.

3. Deposit the Service Tax with the Govt.

4. File Service Tax Returns twice every year.

This article has been authored by CA Karan Batra from Chartered Club which is a Q&A Forum for all your Tax Queries.

well thanks for such info, this is great amendment into Service tax, but for those who earn more than 20lakh from ad sales there will be no prob, thanks for sharing this. in case of adsense earning there is very less chances to pay attention to this Section. 🙂

Hello, good writeup on service tax in India. I have got few questions, would appreciate an answer.

1. You mentioned export of services is exempted from Service Tax. Does selling domains to non-Indians, earning money from non-Indian affiliate networks (like CJ.com, clickbank.com, Amazon Associates US (not to be confused with Amazon Associates India)), fall under this category?? If yes, any payment from these non-Indian companies doesn’t need to be considered for service tax payments right?

2. How about Google India Payments? Obviously bloggers in India earn in USD but they are converted to INR by Google and they issue cheque or wire transfer. Google India does process the payment, but the usual billing address would be from Google Singapore. This is because Google uses overseas billing account to reduce taxes at their end. Will such payment be exempted as well as they fall under Service exports?

3. Just like you, my auditor did confirm that any USD payment is export of services and is not in the scope of service tax. However I couldn’t get authentic government rulings on this. Even in the links that you have given, this information is missing. May I ask that you help find the source of this information?

4. Say for instance if we receive both INR and USD payments. So as per your article we wouldn’t be paying service tax for USD payment but will be paying service tax for INR payment provided we move over 10 Lakhs limit. Is my understanding correct? If yes, is the 10Lakhs limit is calculated combining USD and INR revenue or just INR revenue.

What is the process of applying for the service tax with the government?

The process of application is fairly simple and can be done online as well. You can register online on this link – https://www.aces.gov.in/STASE/ui/jsp/common/registerWithACES.do